Paychex Reports Q3 FY2025 Revenue of $1.51B and Adjusted EPS of $1.49, Announces Paycor Acquisition to Close in April

Paychex, Inc. reported a solid third quarter for fiscal 2025, achieving 5% year-over-year revenue growth and 6% growth in operating income. The company recorded $1.49 in adjusted diluted EPS, up 8% from the prior year. Notably, Paychex entered into a definitive agreement to acquire Paycor, a strategic move expected to close in April 2025. This acquisition is set to create a combined base of nearly 800,000 customers and bolster Paychex’s position in the digital and AI-driven HCM space. The company also returned $1.2 billion to shareholders in the first nine months through dividends and buybacks.

- Sustained Growth in Revenue and Earnings

- Entered into a Definitive Agreement to Acquire Paycor HCM, Inc. (“Paycor”) with Expected Close in April 2025

- Returned $1.2 Billion to Stockholders in the First Nine Months of Fiscal 2025

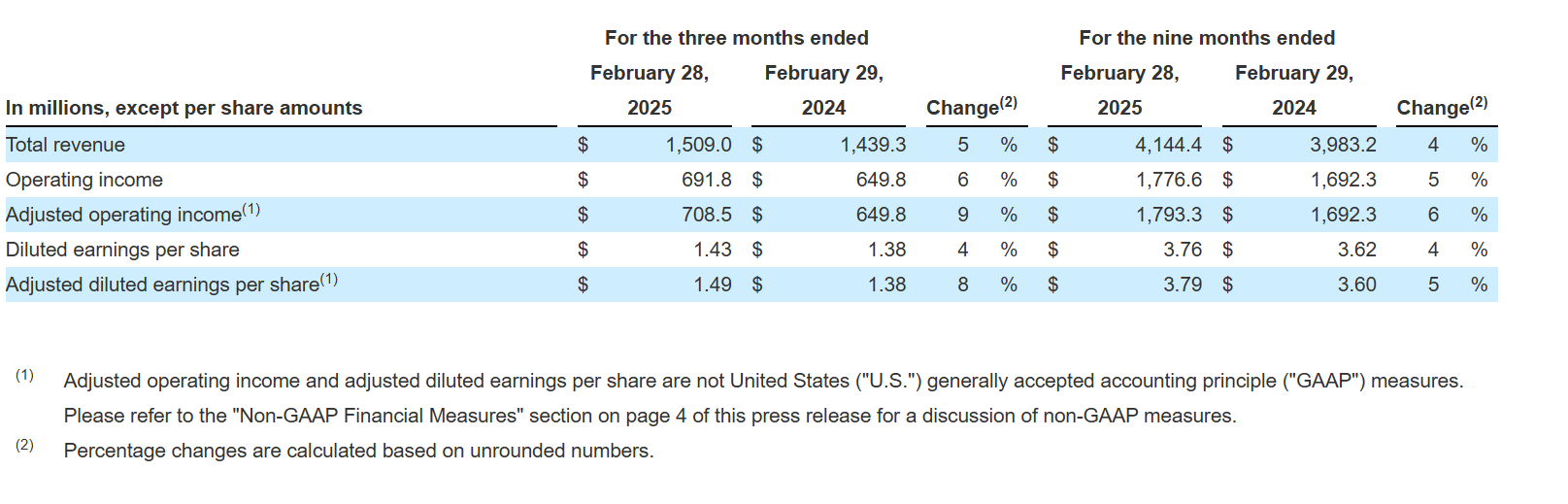

ROCHESTER, N.Y.—Paychex, Inc. (the “Company,” “Paychex,” “we,” “our,” or “us”) today reported results for the fiscal quarter ended February 28, 2025 (the “third quarter”). Results compared with the same period last year were as follows:

President and Chief Executive Officer, John Gibson commented, “The third quarter of this fiscal year has been a transformational time at Paychex. As we position ourselves for the digitally and AI driven future of human capital management (“HCM”), we believe the combination of our continued positive momentum and the pending acquisition of Paycor positions Paychex for continued growth. Total revenue growth in the third quarter was 5% and, excluding the impact of the discontinued Employee Retention Tax Credit (“ERTC”) program, revenue growth was 6%, driven by the strength of our industry-leading HCM solutions. Diluted earnings per share increased 4% and adjusted diluted earnings per share(1) increased 8% during the quarter. Our investments in automation and technology are also boosting efficiency across the organization resulting in operating margins of 45.8% and adjusted operating margins(1) of 46.9%, an increase of 180 basis points compared to the prior year period.”

Gibson also noted, “We look forward to welcoming Paycor to the Paychex family in the coming weeks. Our companies are highly complementary, and our dedicated employees share a common set of values, most importantly a strong customer orientation and focus on providing innovative solutions to real-world challenges. Our expected combined base of nearly 800,000 customers will benefit from having access to the most comprehensive, flexible, and innovative HCM solutions in the industry. By working together, we believe we will be even better positioned to achieve our shared mission of helping businesses, of all sizes, succeed in the years ahead.”

Third Quarter Business Highlights

Total revenue increased to $1.5 billion for the third quarter, representing growth of 5% over the prior year period. Highlights as compared with the corresponding prior year period are as follows:

- Management Solutions revenue increased 5% to $1.1 billion for the third quarter primarily impacted by the following factors:

- Continued growth in the number of clients served across our suite of HCM solutions and client worksite employees for Human Resources (“HR”) Solutions;

- Higher revenue per client resulting from price realization and product penetration, including HR Solutions and Retirement; and

- Lower revenue from ancillary services, primarily due to the expiration of our ERTC program in the prior year period.

- Professional Employer Organization (“PEO”) and Insurance Solutions revenue increased 6% to $365.4 million for the third quarter primarily due to the following:

- Growth in the number of average PEO worksite employees; and

- Increase in PEO insurance revenues.

- Interest on funds held for clients decreased 2% to $42.9 million for the third quarter primarily due to lower average interest rates.

Total expenses increased 4% to $817.2 million for the third quarter primarily due to the following:

- Acquisition-related costs associated with the pending Paycor acquisition;

- Increase in PEO direct insurance costs related to growth in average worksite employees and PEO insurance revenues; and

- Continued investment in product, technology, data, and AI.

Total expenses, excluding acquisition-related costs noted above, increased 1% to $800.5 million for the third quarter compared to the prior year.

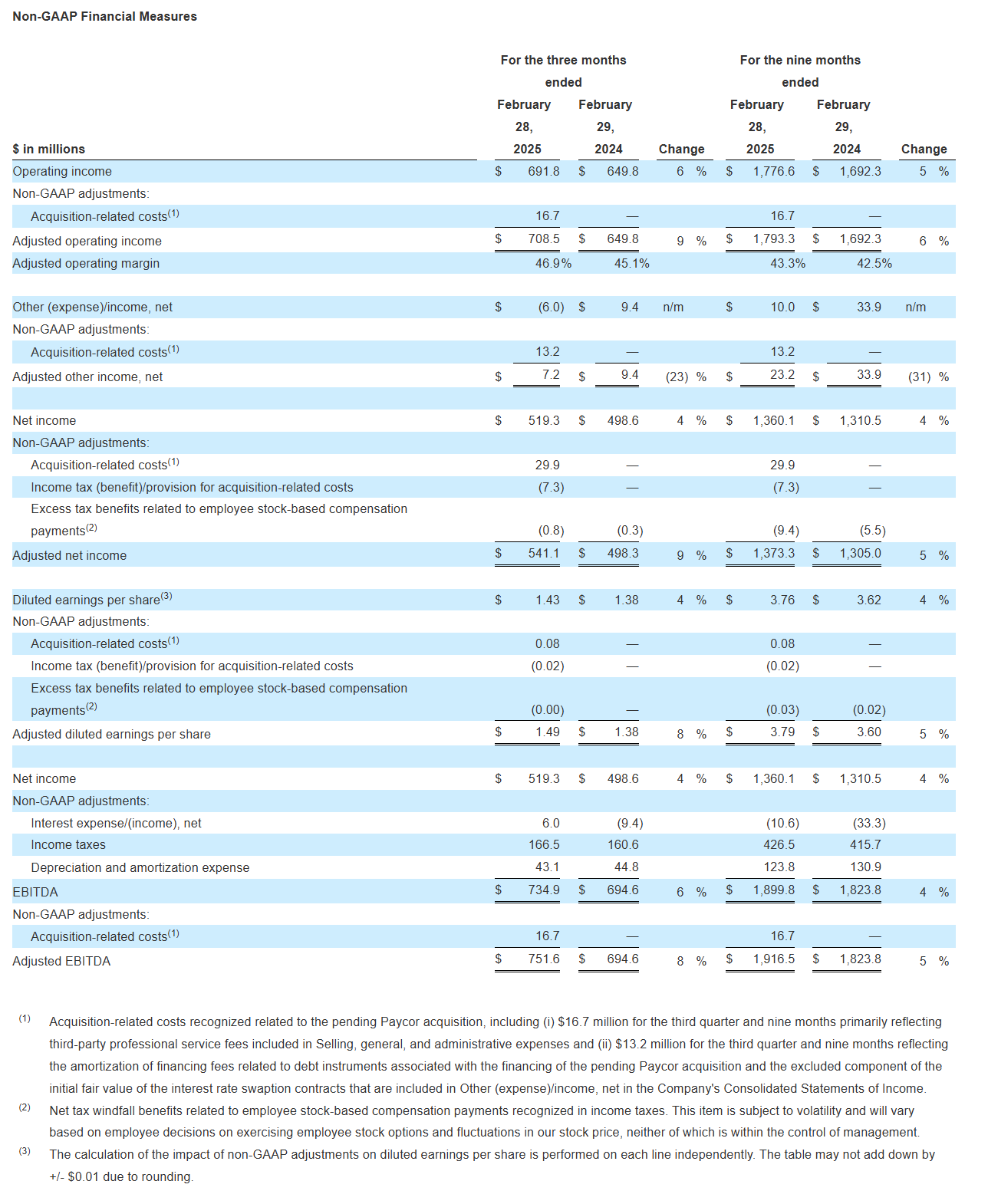

Operating income grew 6% to $691.8 million for the third quarter and adjusted operating income(1) grew 9% to $708.5 million. Operating margin (operating income as a percentage of total revenue) was 45.8% for the third quarter compared to 45.1% for the prior year period. Adjusted operating margin(1) (operating income, as adjusted, as a percentage of total revenue) was 46.9% for the third quarter compared to 45.1% for the prior year period. Operating income and adjusted operating income(1) were impacted by the expiration of the ERTC program.

Other (expense)/income, net decreased $15.4 million to expense of $6.0 million for the third quarter, primarily as a result of acquisition-related costs associated with the pending Paycor acquisition recognized in interest expense and lower average interest rates earned on our corporate investments.

Our effective income tax rate was 24.3% for the third quarter compared to 24.4% for the prior year period. Both periods were impacted by the recognition of net discrete tax benefits related to employee stock-based compensation payments.

Diluted earnings per share and adjusted diluted earnings per share(1) increased 4% to $1.43 per share and 8% to $1.49 per share, respectively, for the third quarter.

Fiscal Year-To-Date Business Highlights

Highlights for the nine months ended February 28, 2025 (the “nine months”) as compared to the corresponding prior year period are as follows:

- Total revenue increased 4% to $4.1 billion.

- Operating income increased 5% to $1.8 billion and adjusted operating income(1) increased 6% to $1.8 billion. Operating margin was 42.9% and adjusted operating margin(1) was 43.3%.

- Diluted earnings per share increased 4% to $3.76 per share. Adjusted diluted earnings per share(1) increased 5% to $3.79 per share.

Financial Position and Liquidity

Our financial position and cash flow generation remained strong during the nine months. As of February 28, 2025, we had:

- Cash, restricted cash, and total corporate investments of $1.7 billion.

- Short-term and long-term borrowings, net of debt issuance costs, of $816.6 million.

- Cash flow from operations was $1.6 billion for the nine months.

Return to Stockholders During the Nine Months

- Paid cumulative dividends of $2.94 per share totaling $1.1 billion.

- Repurchased 828,855 shares of our common stock for $104.0 million.

In addition to reporting operating income, operating margin, other (expense)/income, net, net income, and diluted earnings per share, which are U.S. GAAP measures, we present adjusted operating income, adjusted operating margin, adjusted other income, net, adjusted net income, adjusted diluted earnings per share, earnings before interest, taxes, depreciation, and amortization (“EBITDA”), and adjusted EBITDA which are non-GAAP measures. We believe these additional measures are indicators of the performance of our core business operations period over period. Adjusted operating income, adjusted operating margin, adjusted other income, net, adjusted net income, adjusted diluted earnings per share, EBITDA, and adjusted EBITDA are not calculated through the application of U.S. GAAP and are not required forms of disclosure by the Securities and Exchange Commission (“SEC”). As such, they should not be considered a substitute for the U.S. GAAP measures of operating income, operating margin, other (expense)/income, net, net income, and diluted earnings per share, and, therefore, they should not be used in isolation but in conjunction with the U.S. GAAP measures. The use of any non-GAAP measure may produce results that vary from the U.S. GAAP measure and may not be comparable to a similarly defined non-GAAP measure used by other companies.

Pending Paycor Acquisition

As previously announced, on January 7, 2025, we entered into a definitive agreement to acquire Paycor, a leading provider of HCM, payroll and talent software, to extend our upmarket position and expand our suite of HR technology and advisory solutions. In addition, on February 27, 2025, we announced that the waiting period under the Hart-Scott-Rodino Antitrust Improvements Act of 1976, as amended, had expired with respect to the acquisition. The acquisition is expected to close in April 2025, subject to other customary closing conditions.

Business Outlook

Our business outlook for the fiscal year ending May 31, 2025 (“fiscal 2025”) incorporates current assumptions and market conditions and excludes any impact from the pending Paycor acquisition. Changes in the macroeconomic environment could alter our guidance. With consideration of these impacts, we have updated our business outlook as follows:

- PEO and Insurance Solutions revenue is now anticipated to grow in the range of 6.0% to 6.5%.

- Adjusted operating margin(1) is now anticipated to be approximately 43%.

- Other aspects of our guidance for fiscal 2025 remain unchanged from what we provided previously.

| (1) | Adjusted operating margin is not a U.S. GAAP measure. Please refer to the “Non-GAAP Financial Measures” section on page 4 of this press release for a discussion of non-GAAP measures. |

Quarterly Report on Form 10-Q (“Form 10-Q”)

We anticipate filing our Form 10-Q for the third quarter within the next couple days, and it will be available at https://investor.paychex.com. This press release should be read in conjunction with the Form 10-Q and the related Notes to Consolidated Financial Statements and Management’s Discussion and Analysis of Financial Condition and Results of Operations contained in that Form 10-Q.

Webcast Details

Interested parties may access the webcast of our Earnings Release Conference Call, scheduled for March 26, 2025, at 9:30 a.m. Eastern Time, at https://investor.paychex.com. The webcast will be archived for approximately 90 days. Our news releases, current financial information, SEC filings, and investor presentations are also accessible at https://investor.paychex.com.

About Paychex

Paychex, Inc. (Nasdaq: PAYX) is an industry-leading HCM company delivering a full suite of technology and advisory services in human resources, employee benefit solutions, insurance, and payroll. The company serves over 745,000 customers in the U.S. and Europe and pays one out of every 12 American private sector employees. The more than 16,000 people at Paychex are committed to helping businesses succeed and building thriving communities where they work and live. To learn more, visit www.paychex.com.

Cautionary Note Regarding Forward-Looking Statements

Certain written statements in this press release may contain, and members of management may from time to time make or discuss statements which constitute, “forward-looking statements” within the meaning of the safe harbor provisions of the U.S. Private Securities Litigation Reform Act of 1995. Forward-looking statements can be identified by such words and phrases as “expect,” “outlook,” “will,” guidance,” “projections,” “strategy,” “mission,” “anticipate,” “believe,” “can,” “could,” “design,” “look forward,” “may,” “possible,” “potential,” “should” and other similar words or phrases. Forward-looking statements include, without limitation, all matters that are not historical facts. Examples of forward-looking statements include, among others, statements we make regarding operating performance, events, or developments that we expect or anticipate will occur in the future, including statements relating to our outlook, revenue growth, earnings, earnings-per-share growth, and similar projections, and the pending acquisition of Paycor.

Forward-looking statements are neither historical facts nor assurances of future performance. Instead, they are based only on our current beliefs, expectations, and assumptions regarding the future of our business, future plans and strategies, projections, anticipated events and trends, the economy, and other future conditions. Because forward-looking statements relate to the future, they are subject to known and unknown uncertainties, risks, changes in circumstances, and other factors that are difficult to predict, many of which are outside our control. Our actual performance and outcomes, including without limitation, our actual results and financial condition, may differ materially from those indicated in or suggested by the forward-looking statements. Therefore, you should not rely on any of these forward-looking statements. Important factors that could cause our actual results and financial condition to differ materially from those indicated in the forward-looking statements include, among others, the following:

- our ability to keep pace with changes in technology or provide timely enhancements to our solutions and support;

- software defects, undetected errors, and development delays for our solutions;

- the possibility of cyberattacks, security vulnerabilities or Internet disruptions, including data security and privacy leaks, and data loss and business interruptions;

- the possibility of failure of our business continuity plan during a catastrophic event;

- the failure of third-party service providers to perform their functions;

- the possibility that we may be exposed to additional risks related to our co-employment relationship with our PEO business;

- changes in health insurance and workers’ compensation insurance rates and underlying claim trends;

- risks related to acquisitions and the integration of the businesses we acquire, including risks related to the acquisition and integration of Paycor;

- our clients’ failure to reimburse us for payments made by us on their behalf;

- the effect of changes in government regulations mandating the amount of tax withheld or the timing of remittances;

- our failure to comply with covenants in our debt agreements;

- changes in governmental regulations, laws, and policies;

- our ability to comply with U.S. and foreign laws and regulations;

- our compliance with data privacy and artificial intelligence laws and regulations;

- our failure to protect our intellectual property rights;

- potential outcomes related to pending or future litigation matters;

- the impact of macroeconomic factors on the U.S. and global economy, and in particular on our small- and medium-sized business clients;

- volatility in the political and economic environment, including inflation and interest rate changes;

- our ability to attract and retain qualified people; and

- the possible effects of negative publicity on our reputation and the value of our brand.

Any of these factors, as well as such other factors as discussed in our SEC filings, could cause our actual results to differ materially from our anticipated results. The information provided in this document is based upon the facts and circumstances known as of the date of this press release, and any forward-looking statements made by us in this document speak only as of the date on which they are made. Except as required by law, we undertake no obligation to update these forward-looking statements after the date of issuance of this press release to reflect events or circumstances after such date, or to reflect the occurrence of unanticipated events.