ADP, a global leader in human capital management solutions, reported a 6% revenue increase in the second quarter of fiscal 2024, reaching $4.7 billion. The growth, consistent in organic constant currency, reflects the company’s robust financial performance. Net earnings rose by 8% to $878 million, with adjusted net earnings at a similar increase. The Adjusted EBIT grew 7% to $1.1 billion, enhancing the EBIT margin to 24.6%. This growth trajectory is mirrored in a 9% increase in diluted earnings per share (EPS), achieving $2.13. The report emphasizes ADP’s commitment to delivering top-notch HCM products and services, underscored by strong client satisfaction and retention rates. This performance positions ADP for sustained growth and profitability, with a clear focus on long-term shareholder value.

ADP Reports Second Quarter Fiscal 2024 Results

•Revenues increased 6% compared to last year’s second quarter to $4.7 billion; 6% organic constant currency

•Net earnings increased 8% to $878 million, and adjusted net earnings increased 8% to $881 million

•Adjusted EBIT increased 7% to $1.1 billion, and adjusted EBIT margin increased 20 basis points to 24.6%

•Diluted earnings per share (“EPS”) increased 9% to $2.13; adjusted diluted EPS increased 9% to $2.13

ROSELAND, N.J. – January 31, 2024 – ADP (Nasdaq: ADP), a leading global technology company providing human capital management (HCM) solutions, today announced its second quarter fiscal 2024 financial results and updated its fiscal 2024 outlook.

Second Quarter Fiscal 2024 Consolidated Results

Compared to last year’s second quarter, revenues increased 6% to $4.7 billion and 6% on an organic constant currency basis. Net earnings increased 8% to $878 million, and adjusted net earnings increased 8% to $881 million. Adjusted EBIT increased 7% to $1.1 billion, representing an adjusted EBIT margin increase of 20 basis points in the quarter to 24.6%. ADP’s effective tax rate for the quarter was 23.2% on both a reported basis and an adjusted basis. Diluted EPS increased 9% to $2.13, and adjusted diluted EPS increased 9% to $2.13.

“Our momentum to start the year continued into our second quarter with strong revenue and earnings growth,” said Maria Black, President and Chief Executive Officer, ADP. “We are focused on providing exceptional HCM products and outstanding service, and these efforts continued to drive client satisfaction to new heights. We look forward to strengthening our existing client partnerships and to building new ones as we invest in our technology and people.”

“Following another quarter of record bookings and strong retention, we are well-positioned for steady growth over the remainder of the year,” said Don McGuire, Chief Financial Officer, ADP. “And, as always, we remain committed to improving profitability while continuing to invest consistently to position ourselves to deliver long-term sustainable growth for our shareholders.”

Adjusted EBIT, adjusted EBIT margin, adjusted net earnings, adjusted diluted earnings per share, adjusted effective tax rate and organic constant currency are all non-GAAP financial measures. Please refer to the accompanying financial tables at the end of this release for a discussion of why ADP believes these measures are important and for a reconciliation of non-GAAP financial measures to their closest comparable GAAP financial measures.

Second Quarter Segment Results

Employer Services – Employer Services offers a comprehensive range of global HCM and Human Resources Outsourcing solutions. Compared to last year’s second quarter:

•Employer Services revenues increased 8% on a reported basis and 7% on an organic constant currency basis

•U.S. pays per control increased 2%

•Employer Services segment margin increased 170 basis points

PEO Services – PEO Services provides comprehensive employment administration outsourcing solutions. Compared to last year’s second quarter:

•PEO Services revenues increased 3%

•PEO Services revenues excluding zero-margin benefits pass-throughs increased 3%

•Average worksite employees paid by PEO Services increased 2% to about 725,000

•PEO Services segment margin decreased 50 basis points

Included within the results of our segments above:

Interest on Funds Held for Clients – The safety, liquidity, and diversification of ADP clients’ funds are the foremost objectives of the Company’s investment strategy. Client funds are invested in accordance with ADP’s prudent and conservative investment guidelines, and most of the investment portfolio is rated AAA/AA. Compared to last year’s second quarter:

•Interest on funds held for clients increased 20% to $225 million

•Average client funds balances decreased 2% to $32.6 billion

•The average interest yield on client funds increased 50 basis points to 2.8%

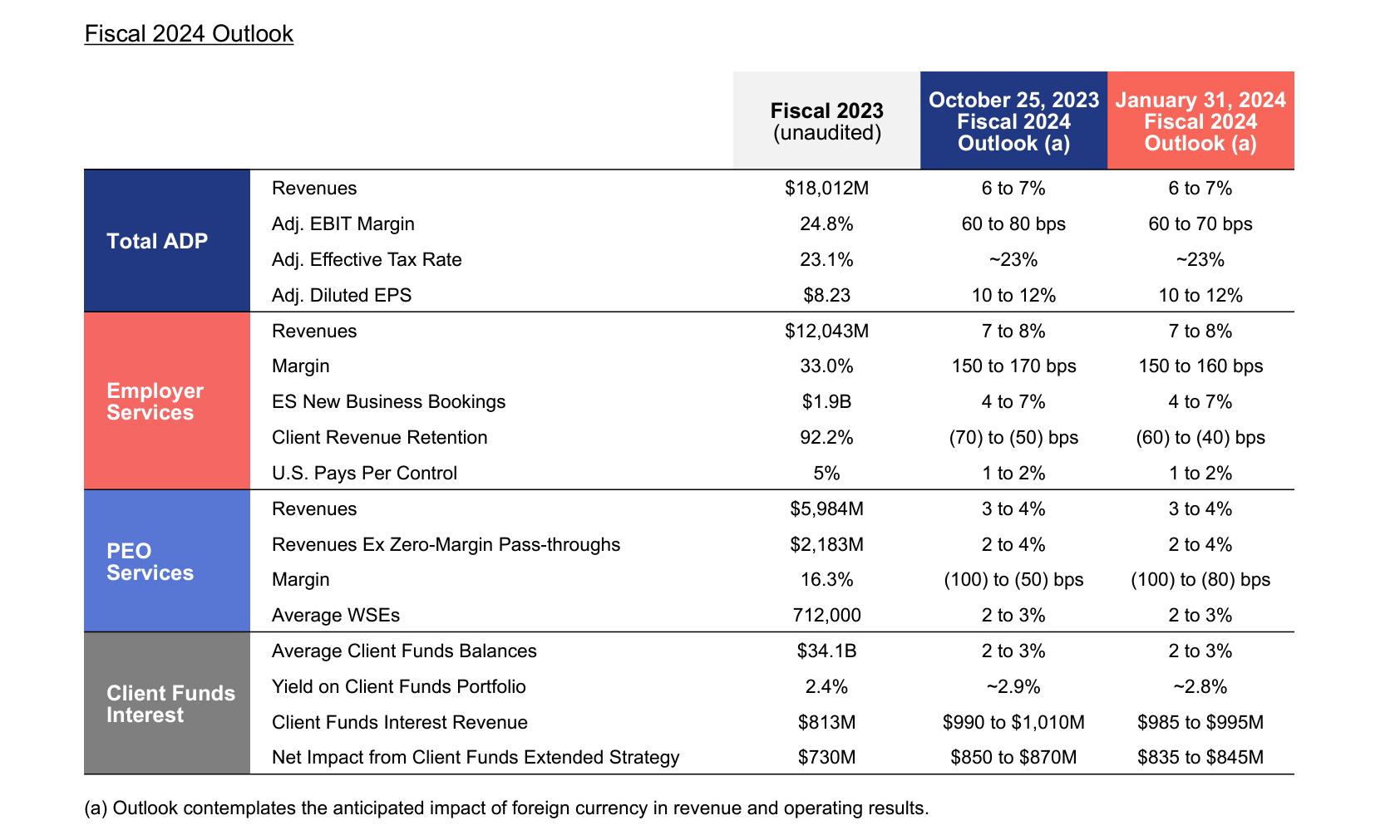

Certain components of ADP’s fiscal 2024 outlook and related growth comparisons exclude the impact of the following items and are discussed on an adjusted basis where applicable. Please refer to the accompanying financial tables for a reconciliation of these adjusted amounts to their closest comparable GAAP measure.

•Fiscal 2023 pre-tax charges of about $9 million related to transformation initiatives

•Fiscal 2023 pre-tax charges of about $1 million related to legal settlements

•Fiscal 2024 expected pre-tax charges of about $5 million related to transformation initiatives

Consolidated Fiscal 2024 Outlook

•Revenue growth of 6% to 7%

•Adjusted EBIT margin expansion of 60 to 70 basis points

•Adjusted effective tax rate of about 23%

•Diluted EPS growth of 10% to 12%

•Adjusted diluted EPS growth of 10% to 12%

Employer Services Segment Fiscal 2024 Outlook

•Employer Services revenue growth of 7% to 8%

•Employer Services margin up 150 to 160 basis points

•Employer Services new business bookings growth of 4% to 7%

•Employer Services client revenue retention decrease of 40 to 60 basis points

•Increase in U.S. pays per control of 1% to 2%

PEO Services Segment Fiscal 2024 Outlook

•PEO Services revenue growth of 3% to 4%

•PEO Services revenue, excluding zero-margin benefits pass-throughs, growth of 2% to 4%

•PEO Services margin down 80 to 100 basis points

•PEO Services average worksite employee count growth of 2% to 3%

Client Funds Extended Investment Strategy Fiscal 2024 Outlook

The interest assumptions in our outlook are based on Fed Funds futures contracts and various forward yield curves as of January 30, 2024. The Fed Funds futures contracts are used in the client short and corporate cash interest income outlook. A combination of various forward yield curves that reflect our investment mix, resulting in a blended rate of 4.0%, was used to forecast new purchase rates across the client and corporate extended and client long portfolios over the remainder of the fiscal year.

•Interest on funds held for clients of $985 to $995 million; this is based on anticipated growth in client funds balances of 2% to 3% and an average yield that is anticipated to increase to 2.8%

•Total contribution from the client funds extended investment strategy of $835 to $845 million

About ADP (Nasdaq: ADP)

Designing better ways to work through cutting-edge products, premium services, and exceptional experiences that enable people to reach their full potential. HR, Talent, Time Management, Benefits, and Payroll. Informed by data and designed for people. Learn more at ADP.com.