ADP Delivers Strong FY25 Results with $20.6B Revenue, Sets Confident Outlook for FY26

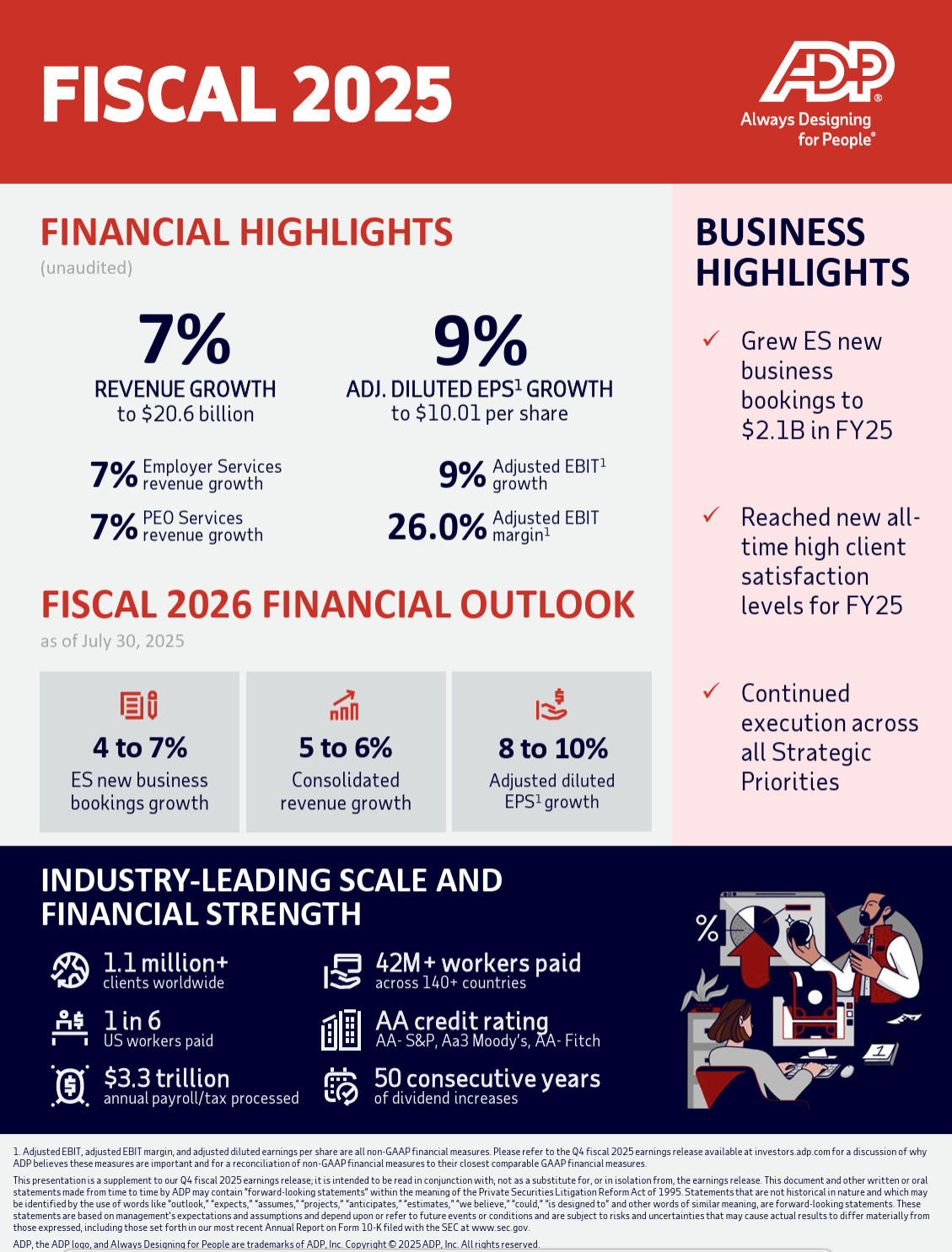

ADP reported strong results for fiscal year 2025, with revenue growing 7% to $20.6 billion and adjusted diluted EPS rising 9% to $10.01. Both its Employer Services and PEO Services divisions delivered 7% revenue growth, fueled by high client satisfaction and new business momentum. Adjusted EBIT rose 9%, reaching a margin of 26.0%. For fiscal 2026, ADP projects continued growth, including 5–6% revenue gains and 8–10% EPS expansion, supported by a resilient business model, global scale, and disciplined financial management.

Roseland, NJ, July 30, 2025 — ADP (NASDAQ: ADP), a global leader in human capital management and payroll solutions, reported solid financial results for fiscal year 2025, reflecting broad-based growth across its core business segments and high levels of client retention and satisfaction.

For the full year ended June 30, 2025, ADP’s total revenue rose 7% year-over-year to $20.6 billion, while adjusted diluted earnings per share (EPS) climbed 9% to $10.01. Both Employer Services and PEO Services segments posted 7% growth. Adjusted EBIT also rose 9%, reaching $5.3 billion, with EBIT margin improving by 50 basis points to 26.0%.

Employer Services new business bookings reached $2.1 billion for the year, marking a 3% increase from FY24. Client revenue retention remained strong at 92.1%, and U.S. pays per control increased by 1%.

ADP’s CEO Maria Black emphasized the company’s focus on client experience and innovation:

“We concluded FY25 with strong revenue and earnings growth, driven by record-high client satisfaction and resilient execution across segments.”

For fiscal year 2026, ADP projects consolidated revenue growth between 5% and 6%, and adjusted EPS growth between 8% and 10%. The company also expects continued expansion of adjusted EBIT margin by 50 to 70 basis points.

As of FY25, ADP supports over 1.1 million clients across 140+ countries, processes $3.3 trillion in payroll annually, and maintains AA credit ratings from S&P and Fitch. The company also marked 50 consecutive years of dividend increases.

Key FY25 Metrics:

-

Revenue: $20.6B (+7% YoY)

-

Adjusted EPS: $10.01 (+9%)

-

Adjusted EBIT: $5.3B (+9%)

-

Employer Services revenue: $13.88B

-

PEO Services revenue: $6.69B

-

New business bookings (ES): $2.1B

-

EBIT margin: 26.0%

FY26 Guidance:

-

Revenue growth: 5–6%

-

Adjusted EPS growth: 8–10%

-

New business bookings growth (ES): 4–7%

ADP’s consistent financial performance underscores its strong market positioning and operational discipline amid evolving workforce needs.